Condo Insurance in and around Fairlawn

Get your Fairlawn condo insured right here!

State Farm can help you with condo insurance

Your Stuff Needs Insurance—and So Does Your Condominium.

Are you investing in condo ownership for the first time? Or have you been a condo owner before? Either way, it can be a good idea to get coverage for your condominium with State Farm's Condo Unitowners Insurance.

Get your Fairlawn condo insured right here!

State Farm can help you with condo insurance

Condo Coverage Options To Fit Your Needs

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has fantastic options to keep your condo and its contents protected. You’ll get coverage options to correspond with your specific needs. Thank goodness that you won’t have to figure that out alone. With personal attention and fantastic customer service, Agent Chad Sokolowski can walk you through every step to help generate a plan that secures your condo unit and everything you’ve invested in.

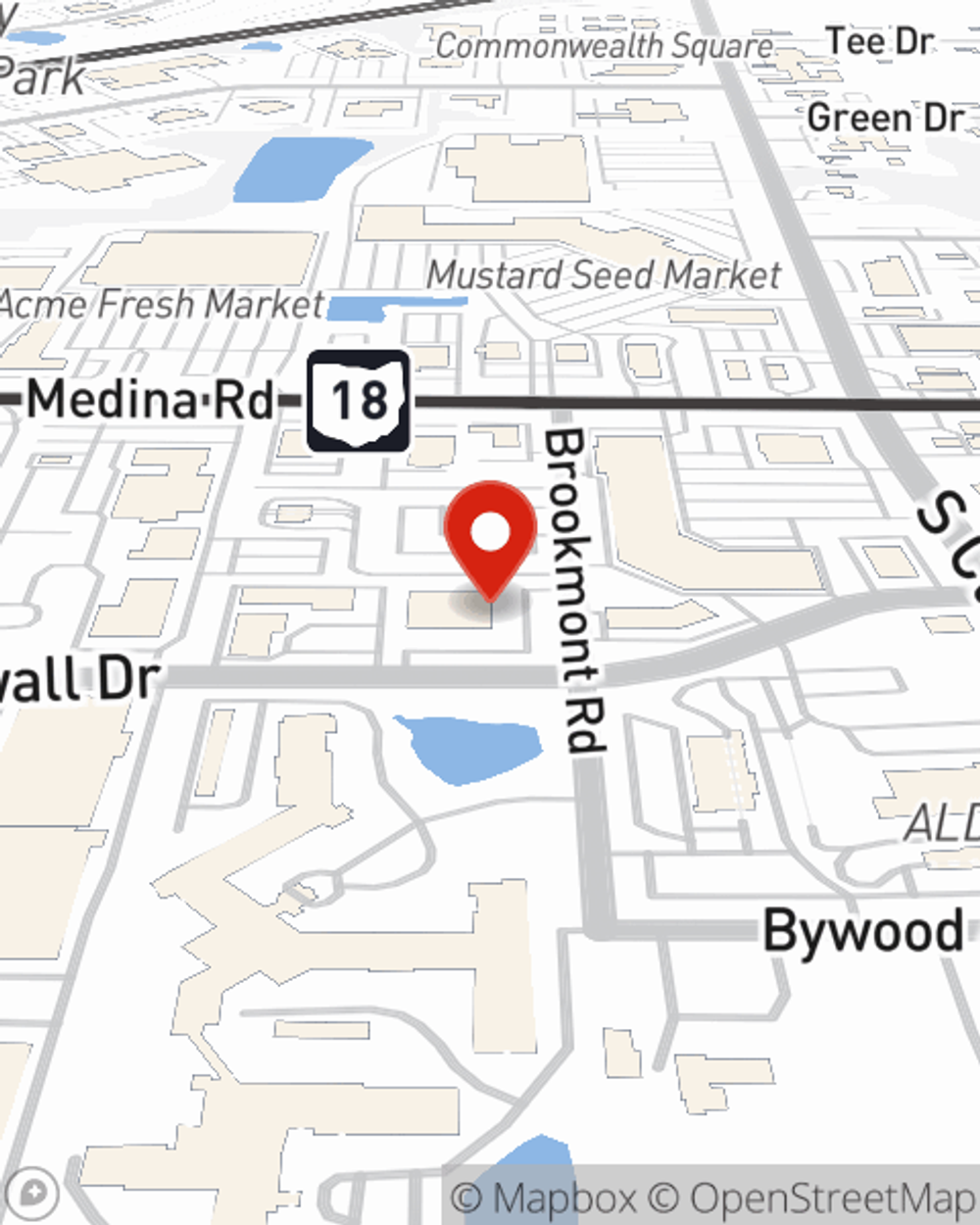

Getting started on an insurance policy for your condominium is just a quote away. Stop by State Farm agent Chad Sokolowski's office to learn more about your options.

Have More Questions About Condo Unitowners Insurance?

Call Chad at (330) 960-2423 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Chad Sokolowski

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.